Finexy offers a simplified approach to sophisticated investing through machine learning-based tools that help investors make intelligent data-driven decisions regarding their portfolio.

NG Logic was contracted to build a custom solution that would provide core Finexy business functionality of assisting investors in making better decisions based on real-world data analysis.

Our team of highly experienced engineers created a solution that utilizes machine learning to analyze asset portfolios and test them against real market data.

Key solution features:

- Investment strategy analysis for portfolio optimization

- Asset ratio suggestions based on investment strategy preferences

- Backtesting against historical data

- Investment portfolio augmentation for optimizing interest rate

Challenge

Choosing the right asset portfolio

Choosing the right investment portfolio and the ratio between separate assets to maximize the interest rate is one of the main challenges when building an investment strategy.

Many variables need to be considered, like the investment time horizon, risk factors, budget, and other factors.

These are some of the crucial decisions to be made before composing an optimal asset portfolio. Decisions shouldn’t be arbitrary but backed with hard data and detailed analysis.

Gathering the correct and relevant data sets and making them relevant to each case scenario might get overwhelming relatively fast if not done correctly and in a structured manner.

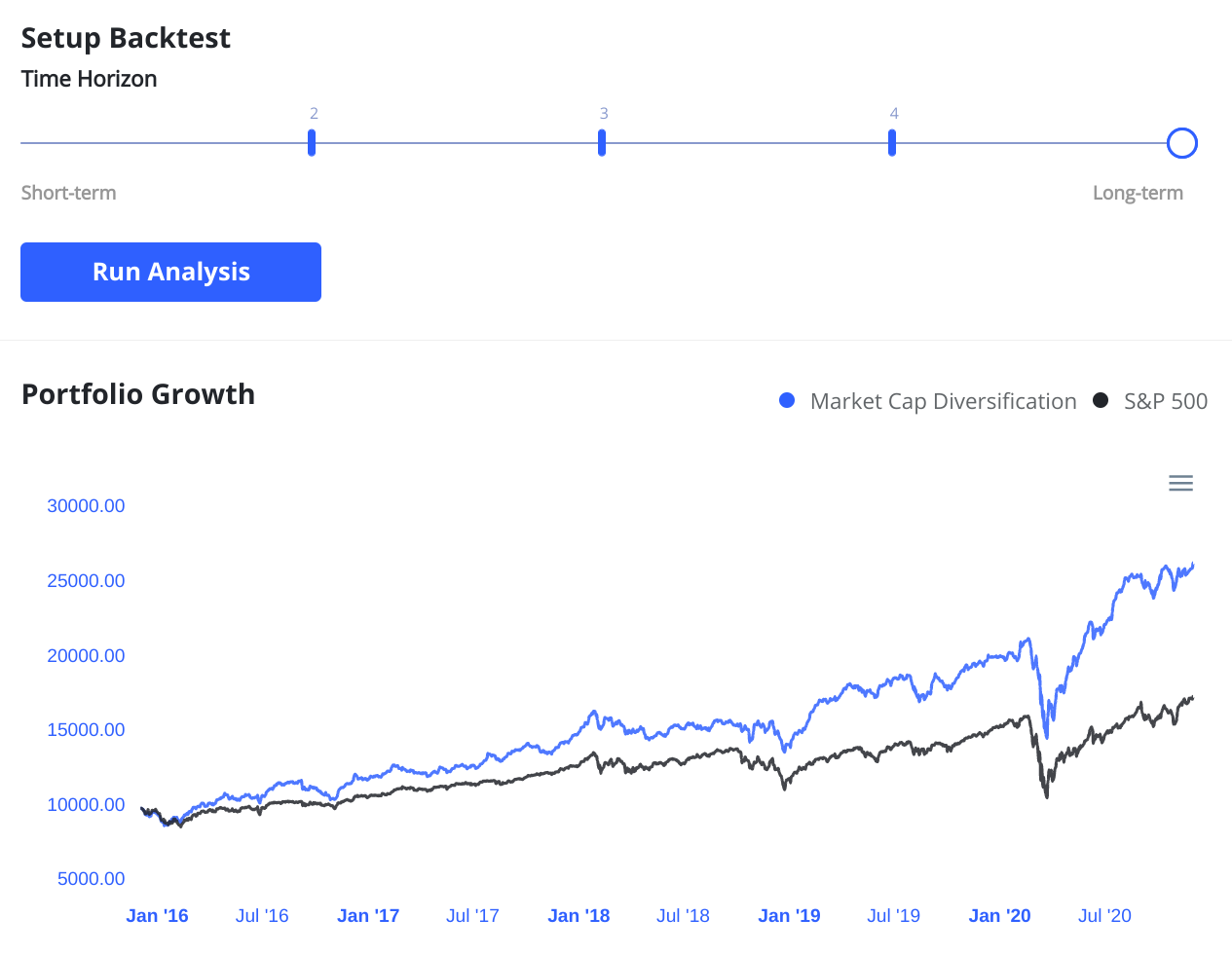

Back-testing with historical data

Before choosing your investment strategy and building the final portfolio it’s a good idea to backcheck your picks against historical data. The tricky part is to pick the right and relevant data from the all-present noise.

Backtesting with historical data might bring another challenge when it comes to picking an appropriate data set for the purpose of analyzing the potential asset portfolio. Making the data relevant will differentiate between optimal and suboptimal testing conditions which might have a major impact on the future investment strategy.

Solution

Building the portfolio from the ground up

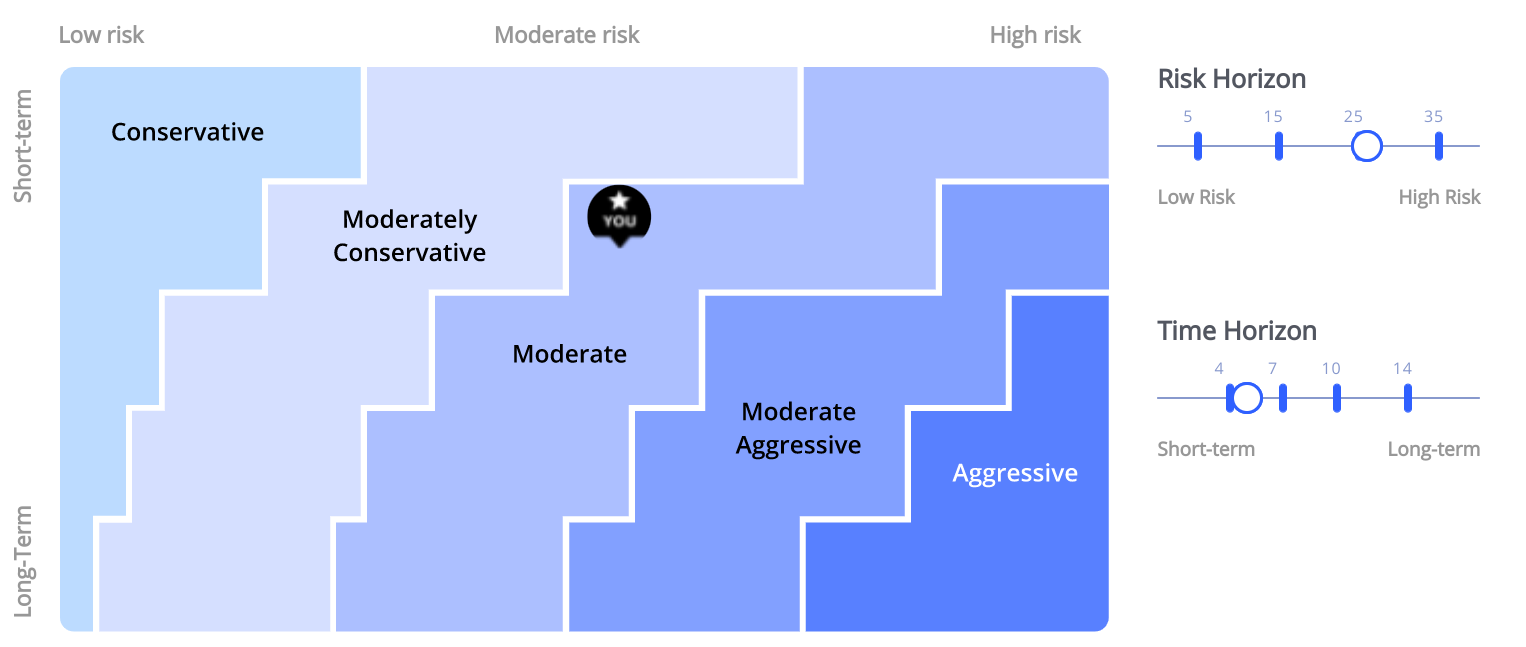

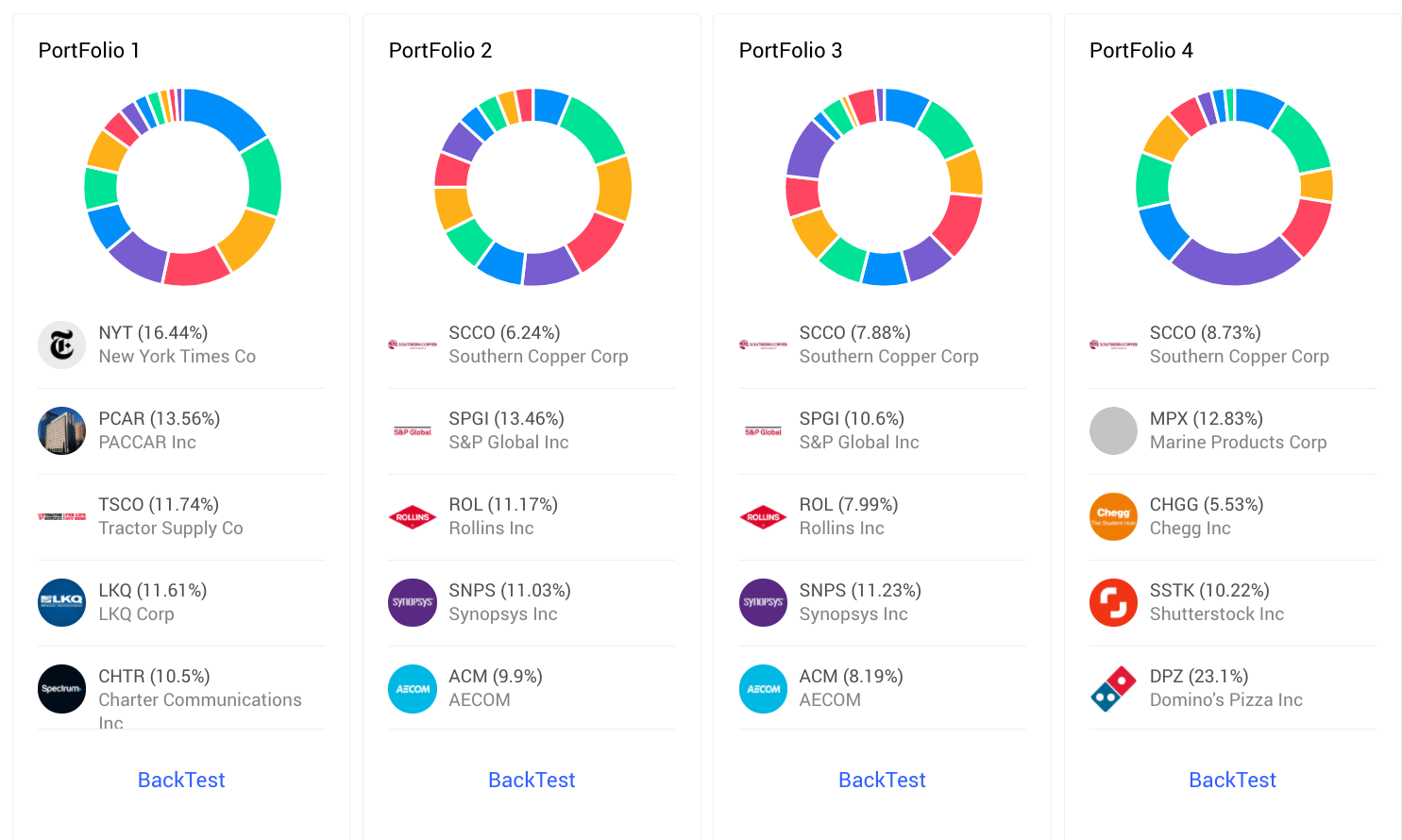

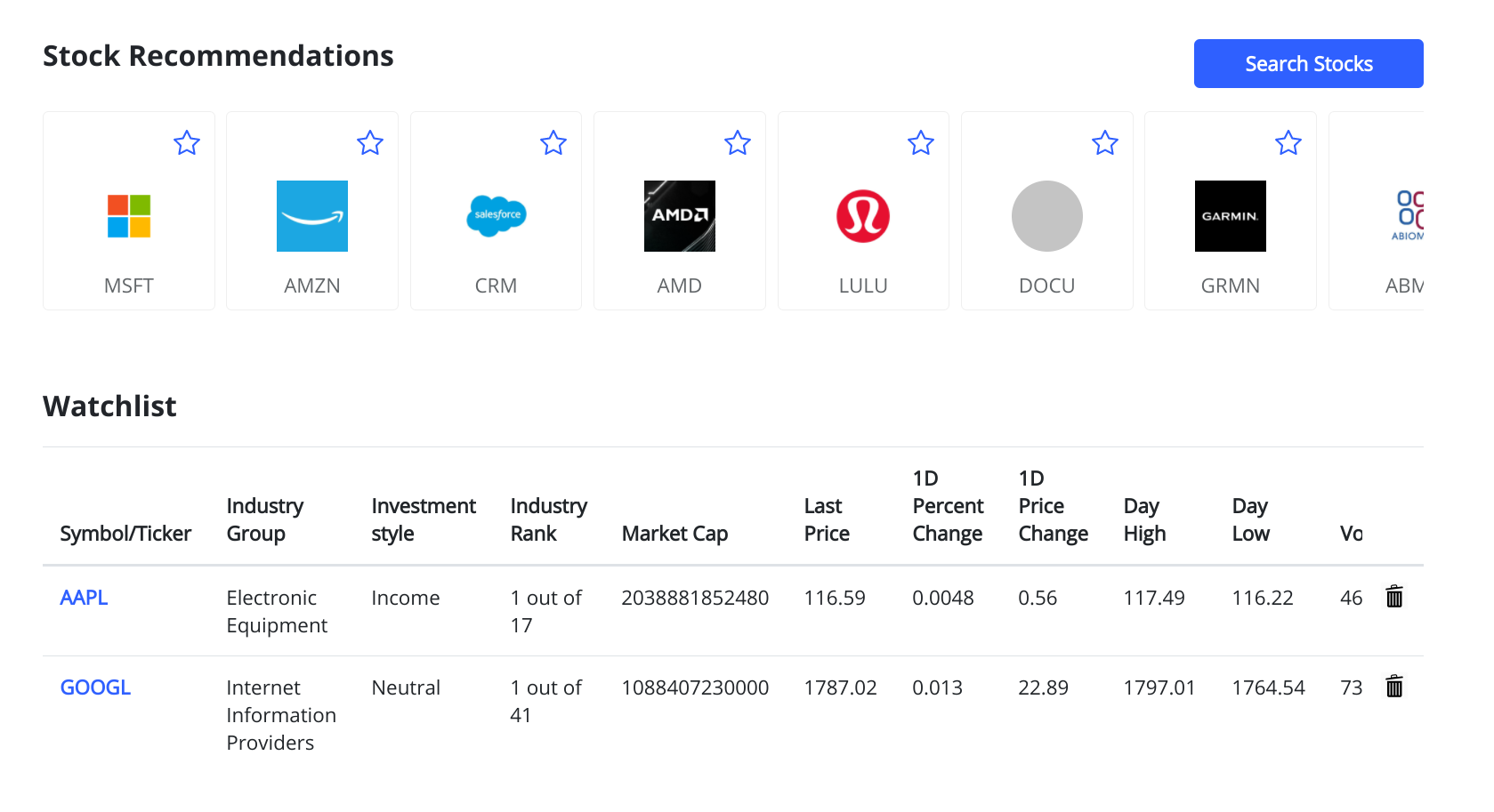

To address the aforementioned challenges our team came up with a 2-way solution. The first one is focused on building a brand-new portfolio from the ground up. The machine learning-based algorithm analyses the investor’s preferences and financial capabilities. The variables include the preferred time frame and how aggressive the strategy can be.

A distinct set of data provided by the investor is being put against market information in order to build a unique set of potential portfolios. The algorithm builds each portfolio around industries with no or minimal overlap. This helps to diversify the assets so that fluctuations in one sector don’t have as strong of an impact on the entire investment. Additionally in any of the sectors, a set of companies is chosen in a way that they represent most closely the investor’s individual preferences.

Updating a pre-existing portfolio

The second solution is targeted at investors with pre-existing asset portfolios who wish to optimize profits and decrease the impact of market (or sector-specific) fluctuations.

In this case, the algorithm takes the investor’s preferences regarding the investment strategy but focuses on augmenting the current portfolio, rather than building an entirely new set from the ground up.

To achieve that a strong focus is being put on finding complementary assets to the ones that are already in the portfolio. Within these industries, a set of distinct uncorrelated companies is being found to make the spectrum more diverse and lower the risk. This process allows the reduction of portfolio volatility in the long run while preserving the overall investment strategy and personal investor preferences.

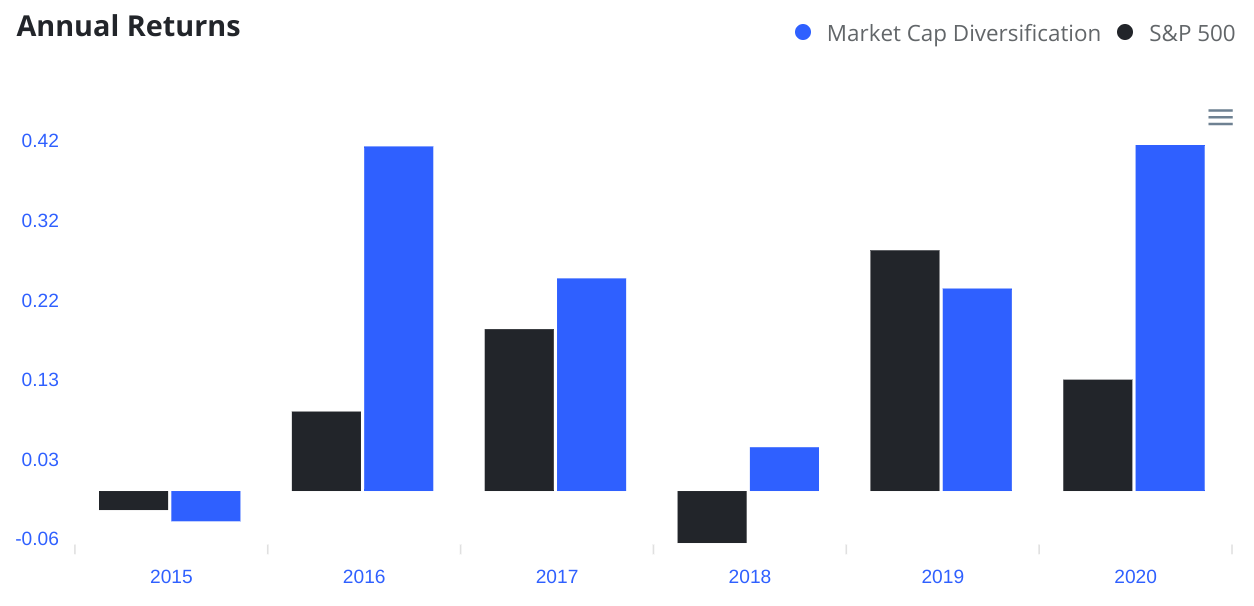

Common strategy testing approach

Both of the aforementioned solutions have a similar strategy back-testing tools, heavily utilizing historical market data. This testing method takes into consideration only past data that was available in the time period and neglects anything that came later.

For both tested and live portfolios, the solution updated itself periodically and constantly. This helps always keep the asset ratios most optimal and in line with the predetermined investment strategy, in accordance with the latest market data.

+1 (888)

413 3806

+1 (888)

413 3806